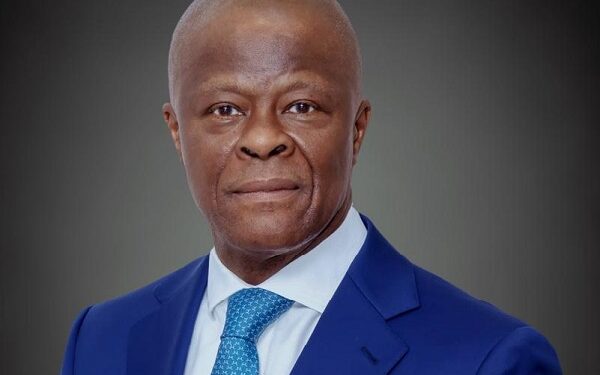

Nigeria’s Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has raised concerns over the rising cost of borrowing across Africa, warning that commercial loan rates exceeding 10 per cent are choking development efforts on the continent.

Edun spoke during an interview with CGTN at the 39th African Union Summit in Addis Ababa, where African leaders deliberated on economic cooperation, financing constraints and long-term development strategies.

According to him, “African economies and African countries are finding themselves paying well over 10% per annum for commercial debt,” describing such rates as unsustainable for nations that require heavy investments in infrastructure, healthcare, education and industrial growth.

The minister highlighted troubling global financial data, noting that developing countries paid approximately $173 billion in debt servicing in 2024, while foreign direct investment (FDI) into those economies remained below $100 billion.

“That means more money is going out in debt service than is coming in through overseas development assistance or foreign direct investment,” Edun said.

He warned that the imbalance is placing enormous strain on government budgets, diverting funds away from critical development projects to debt repayments.

Edun said African governments are pushing for reforms in the global financial architecture to secure lower and fairer borrowing rates.

“That is not a sustainable way to finance development,” he stressed, adding that there is sufficient global financial capacity and technical expertise to design innovative risk-sharing mechanisms that would reduce lending risks and lower interest rates for developing economies.

He argued that better global coordination could unlock affordable financing and improve access to capital for African nations.

The minister also expressed concern about what he described as a gradual retreat from multilateral cooperation and rules-based global trade a shift that could disproportionately affect developing countries.

To counter these global headwinds, Edun said African countries must reform their domestic economies by strengthening public finance management, improving policy implementation and building economic resilience.

“What that means for the African Union and the developing world is that a new developmental model and financing model must emerge,” he said, noting that many existing global financial systems were designed decades ago and may no longer reflect current economic realities, including climate challenges and rising debt burdens.

Edun concluded that sustainable growth in Africa will depend on simultaneous reforms at both the international and national levels.

While global institutions must create fairer lending frameworks, African governments must also pursue disciplined fiscal policies and structural reforms.

He emphasised that affordable financing remains essential for economic expansion, poverty reduction and competitiveness, warning that without systemic reform, rising debt costs could undermine the continent’s long-term stability.